VeroESG

ESG, Untangled

What sparked this project?

Role: UX, UI, & Brand

Client: MunichRe

Software: Figma, Adobe suite

Private markets are facing increasing investor and regulatory pressure to analyze, track, monitor, and manage ESG factors.

Mission: Solve ESG forPrivate Equity

To launch into the POC stage of work, assumptions about the problem had been made:

- Private Equity firms were pressured by their limited partners to care about ESG

- Limited Partners expected an “ESG report” output

- Private Equity firms did not not know how to get started with ESG

Based on this, there were two assumptions around the MVP solution:

- Materiality Mapping was core function that the PE firm would pay for

- Automated exporting of reporting to reporting bodies was a base requirement

How did you approach research?

When it comes to B2B there are a few ways to test your assumptions & hypothesis, but nothing will truly beat speaking directly to potential customers.

Not long into the POC stage of the project, we signed two Co-Creation Customers to act as users and advisors for our solution. Note: Co-Creation Customers are generally businesses who fall into the segment of users who have been prioritized/believed to have the strongest and addressable pain points and are willing to exchange their time and energy to help shape our team’s product, often in hopes of both having their problem solved and receiving a discount for their trouble.

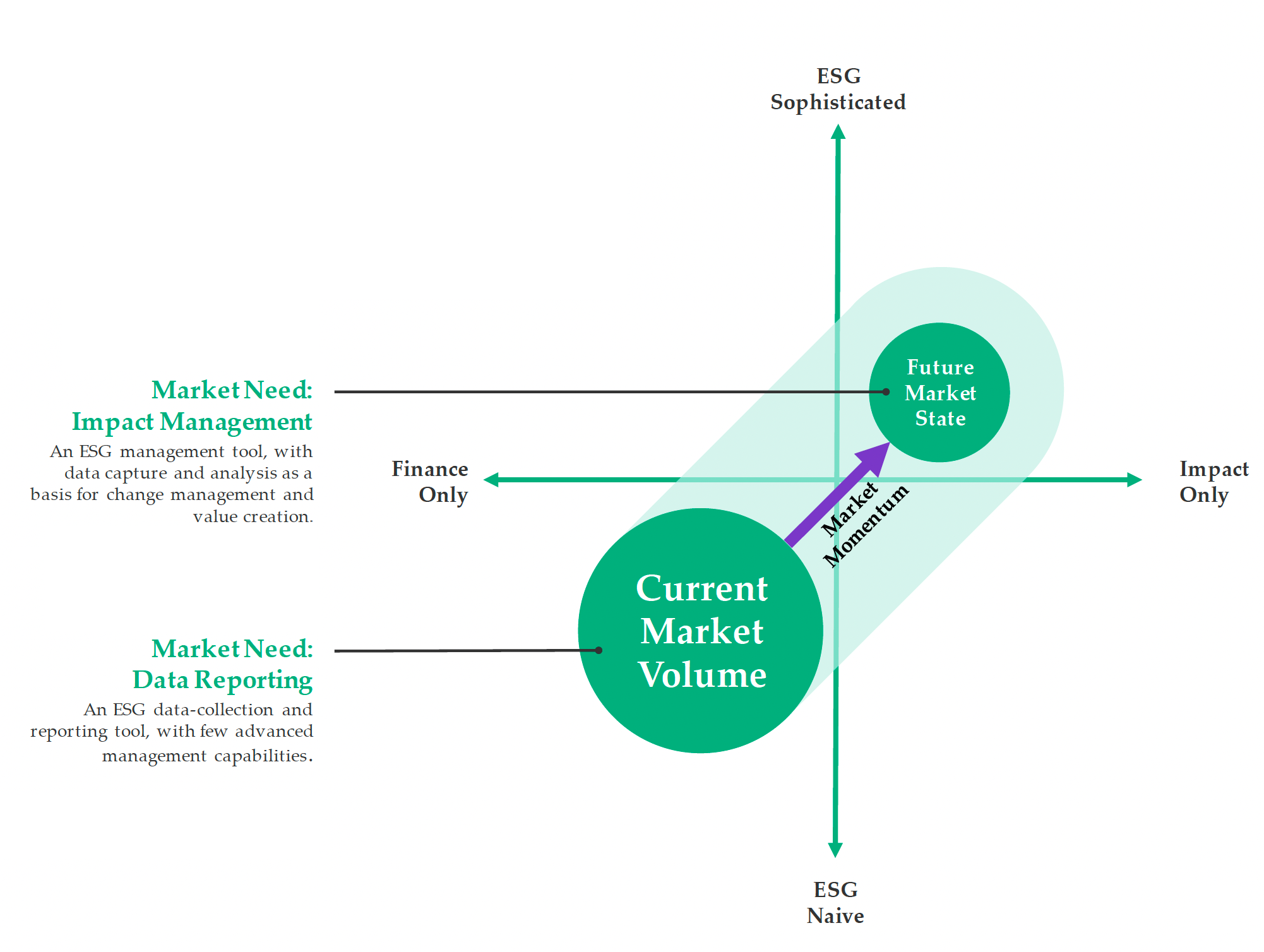

ESG sophistication is a spectrum, and these two users netted out at both ends.

Customer 1: Low sophistication, Legal & compliance officers were driven to ESG due to pressure from LPs, unsure where to start – and looking to launch their first ever ESG collection survey.

Customer 2: Highly sophisticated although newly formed initiatives – the Head of ESG was already implementing many activities, including being a member in an ESG working group for other private firms.

How did this research affect what was prioritized?

We quickly learned our product feature assumptions were wrong.

We learned:

- The biggest pain point was in the collection of data itself

- Benchmarking against public companies wasn’t a 1:1

- Communication between PE firms and their Portfolio Companies (PortCos) was a struggle, with progress on collection not being a “black box”

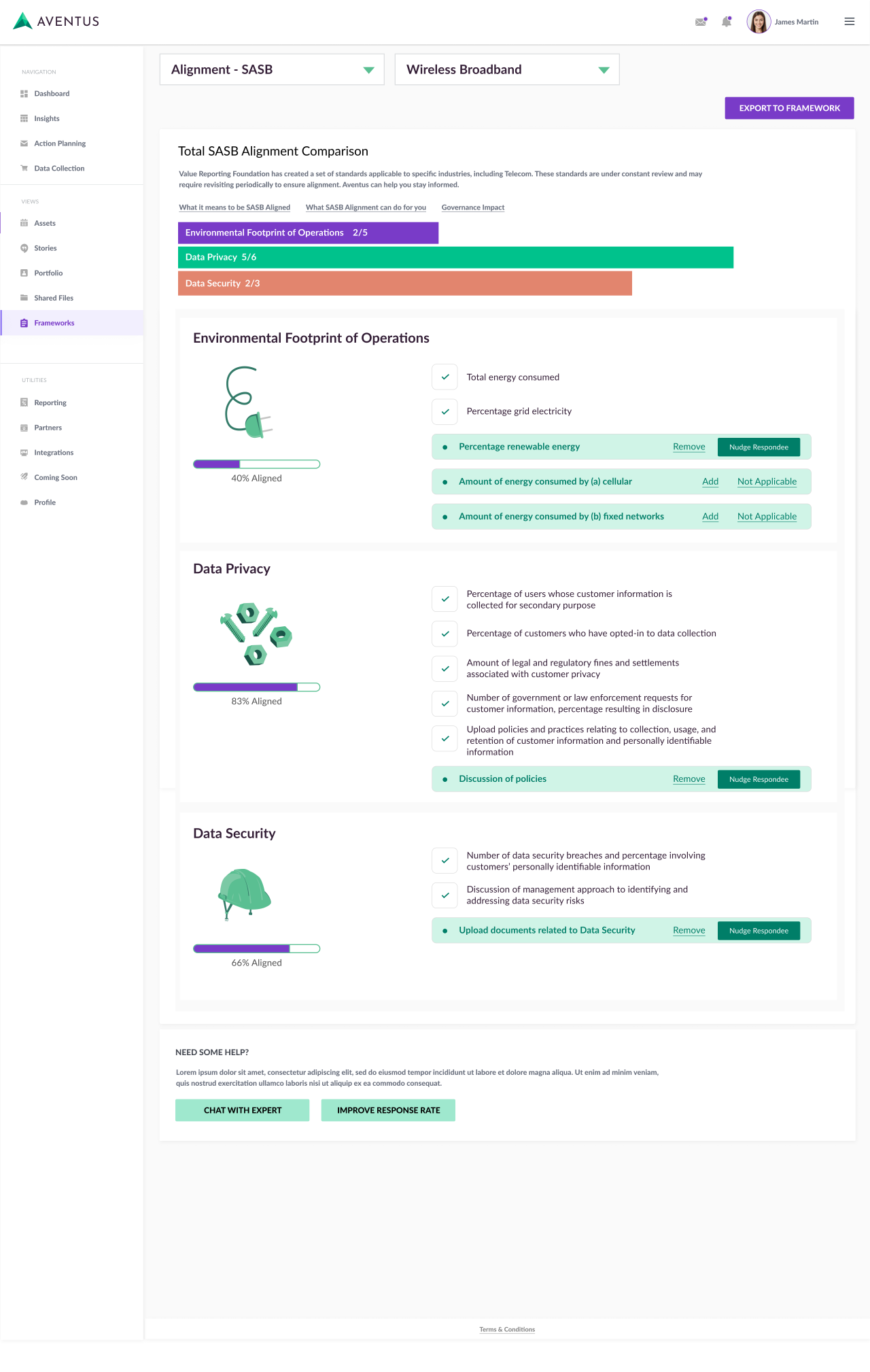

- US based firms weren’t aligning to specific frameworks

- PE firms still needed help identifying metrics to collect- as table stakes, not a solo feature.

- LP reporting was not standard – some wanted more control over what was presented than others.

- ESG reporting was treated as a form of marketing (greenwashing) in the media, but had the potential to drive real outcomes behind closed doors.

It became clear:

We needed a holistic solution for ESG management.

How did you prioritize features for MVP?

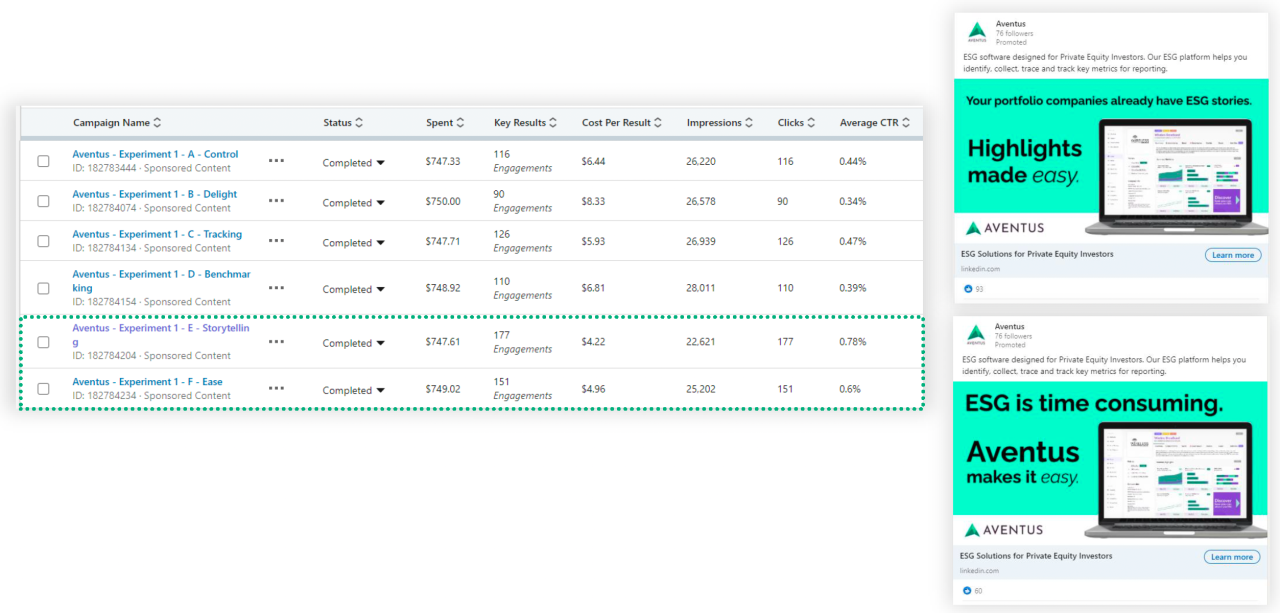

Conducting a series of digital value prop experiments, we tested our:

- Audience/ ad reach (Who & how we reach them)

- Value prop (What the audience will click on)

- Feature sets (How we address their pain points)

Proposed MVP

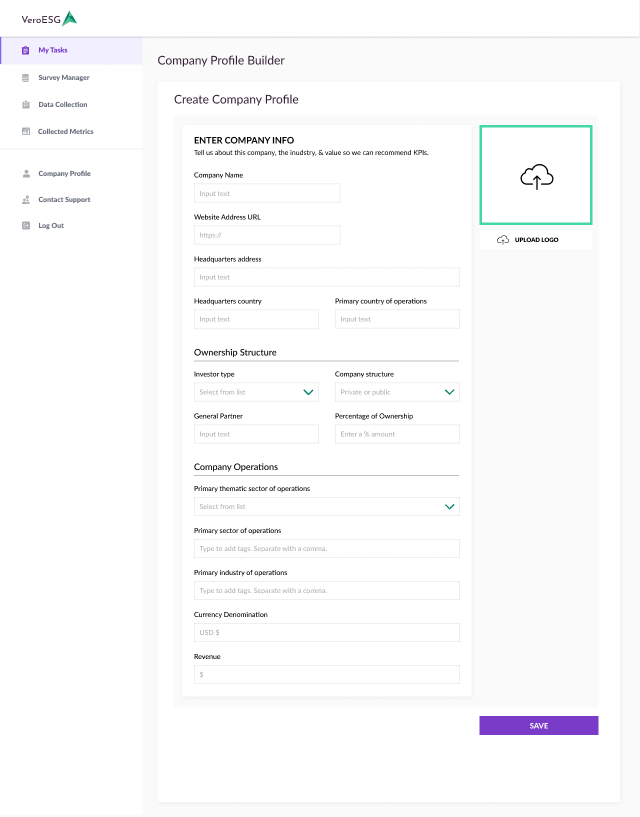

From this, we assumed the PE firm user (GP Admin), and would be creating and managing ESG surveys directly from the platform.

What we built

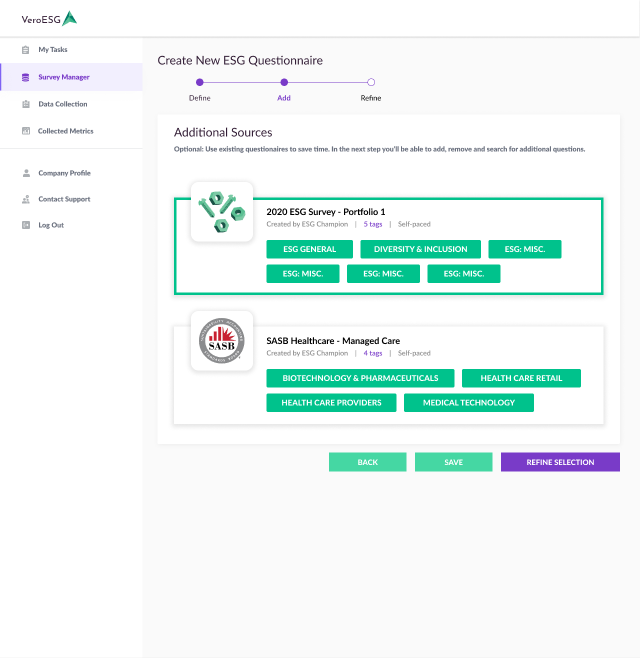

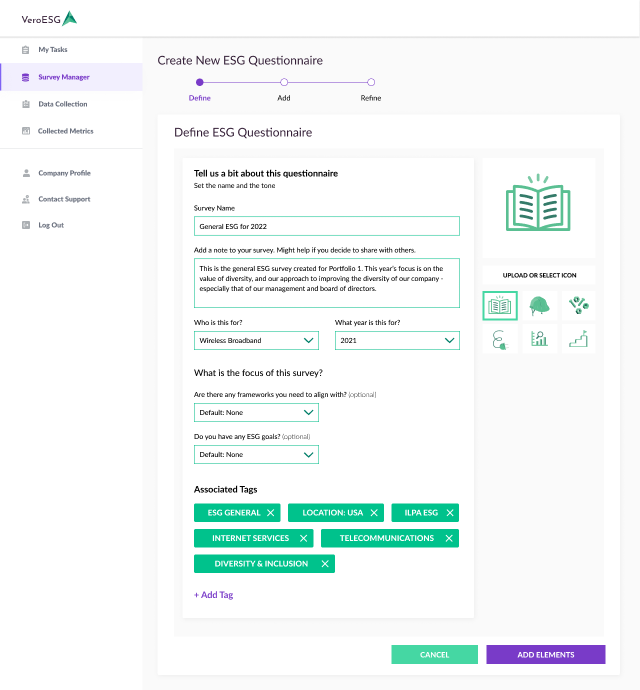

Originally, we assumed the PE firm user (GP Admin), and would be creating and managing ESG surveys directly from the platform.

We learned that often it’s the ESG Champion (a portfolio company employee) managing the survey creation & data collection.

This allowed us to narrow our total user types to start (MVP), while knowing our beta product (MLP) would need multiple user types engaging across the platform.

Early MVP design: Where did you start?

The phrase often used here is ‘Building the plane while flying it’

I needed to prioritize against two key considerations:

- What did we need to learn? (exploratory design)

- What were we ready to build? (ready for handoff)

For learning, I prioritized based on two key things:

- What needed to get built first (impact to timeline)

- What did we need to know more about prior to build?

For build, I looked to the foundational building blocks and repeated elements of the product and worked with the BA & engineering team to determine the best paths forward.

Some of those considerations were things like:

- Client requirements for login (For CIAM, What can be customized? What pre-login experience can we provide the customer?)

- Libraries for response chart design that would allow us flexibility in final output (We landed on Charts.js)

- Structuring the ESG Database to power the backbone

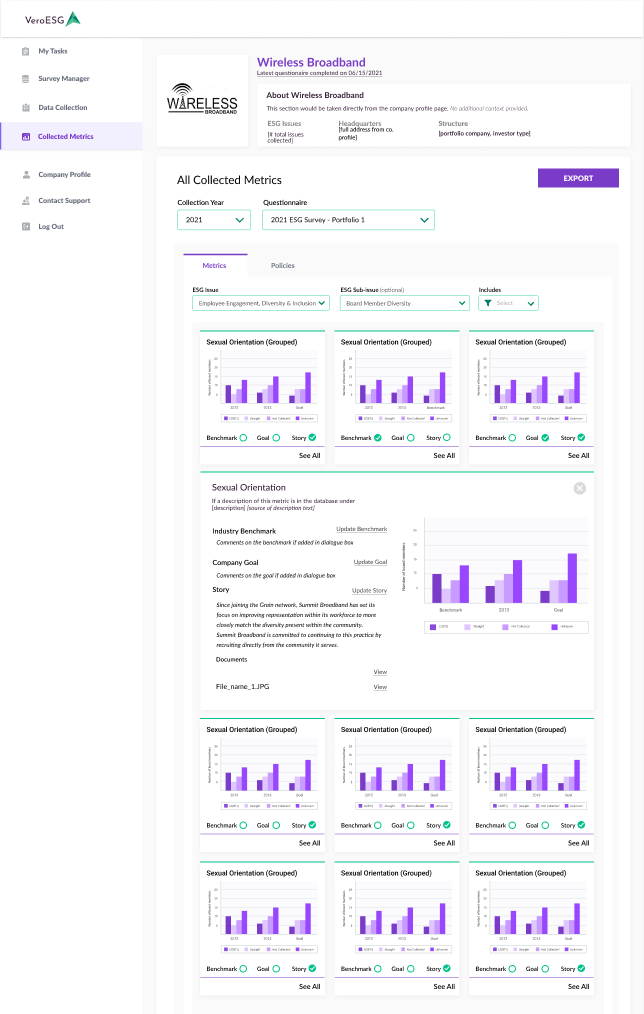

Final MVP design: Where did you land?

While the MVP was in development, we launched into the two additional elements needed for MLP:

- GP Admin experience

- Emissions collection

Towards the end of the MVP build, as we onboarded paying customers, it became clear there was an additional expectation for GHG Emissions accounting to be included.

By partnering with UtilityAPI, we’re able to begin automating the process.

VeroESG Reception

“This is super intuitive and looks easy to use… It’s really helping guide me through the unknown to get to the KPIs that should be tracked and how to track them.”

– Head of Investor Relations, US PE Firm with $2bn AUM

“[VeroESG] fits pretty well at this point. If we can track, report, and compare, that’s great. We hope to grow and with growth we need to be more efficient with our processes, so I think it’s likely we’ll sign up for something like this.”

-Head of Legal & ESG at North American PE firm

“It’s nice and easy and clear. Very easy to read, and easy on the eye. This is the real benefit of the online tools. I do like the balance of public and private benchmarks. I haven’t seen that functionality, and I like the way you’ve displayed it here. It definitely would be in the consideration set.”

-Head of ESG at Global PE firm

Bonus: VeroESG explainer video