ResCentric

Climate Risk Analysis,Actionable Insights

What sparked this project?

Real estate investors and asset managers don’t know the financial impact of climate risk or the most cost-effective mitigation or adaptation measures to take.

Our Vision:

To create an all-in-one climate risk analysis tool that provides in-depth financial impact and recommends mitigation measures to strengthen your real asset investments.

Role: UX, UI, & Brand

Client: MunichRe

Software: Figma, Adobe suite

Complexities of Climate Risk Analysis

Variability in Climate Risk Data

- Absence of clear and future-focused climate data

- Difficulty understanding climate risk within their investment horizon

Access to Asset-Specific Climate Impact

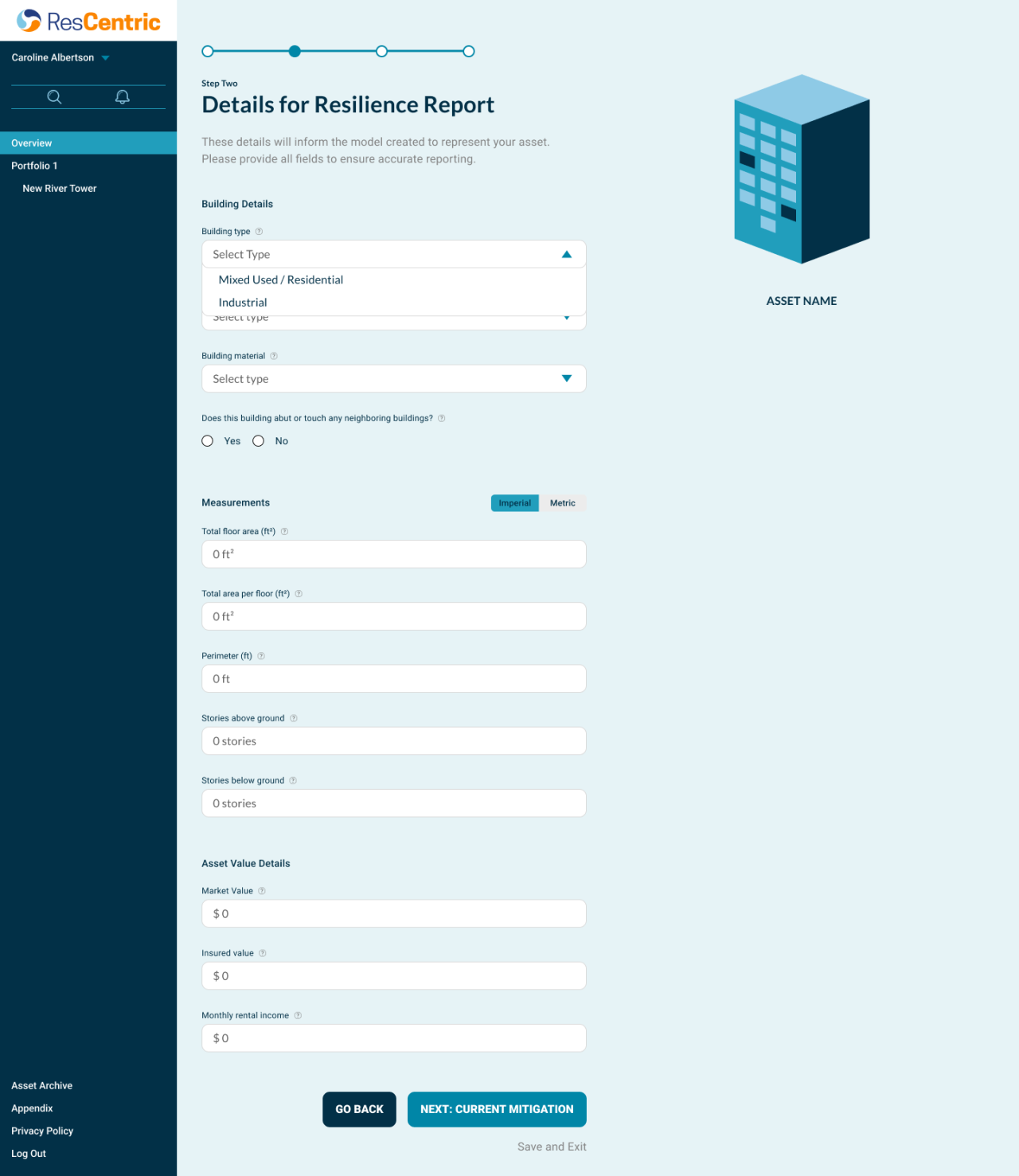

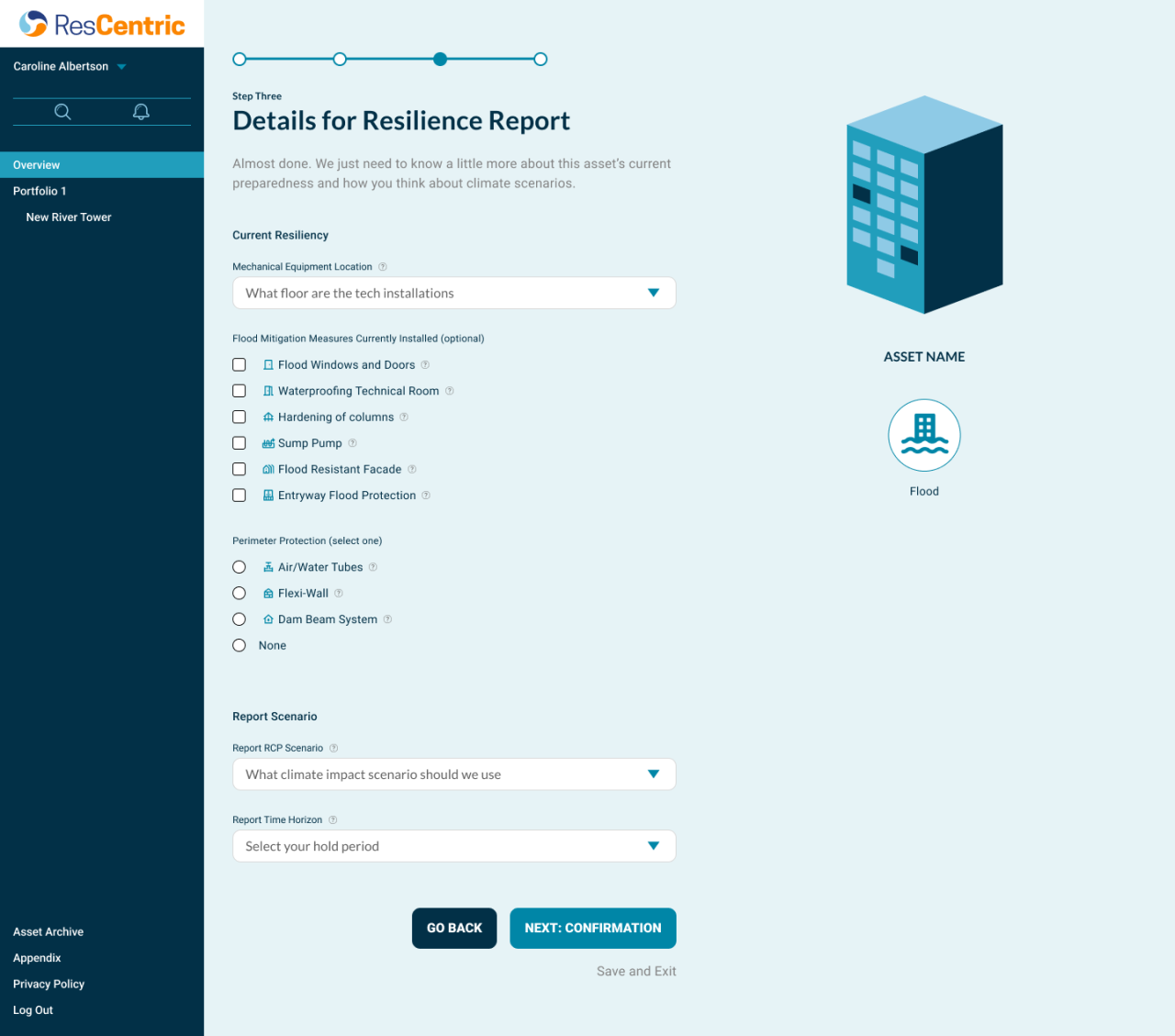

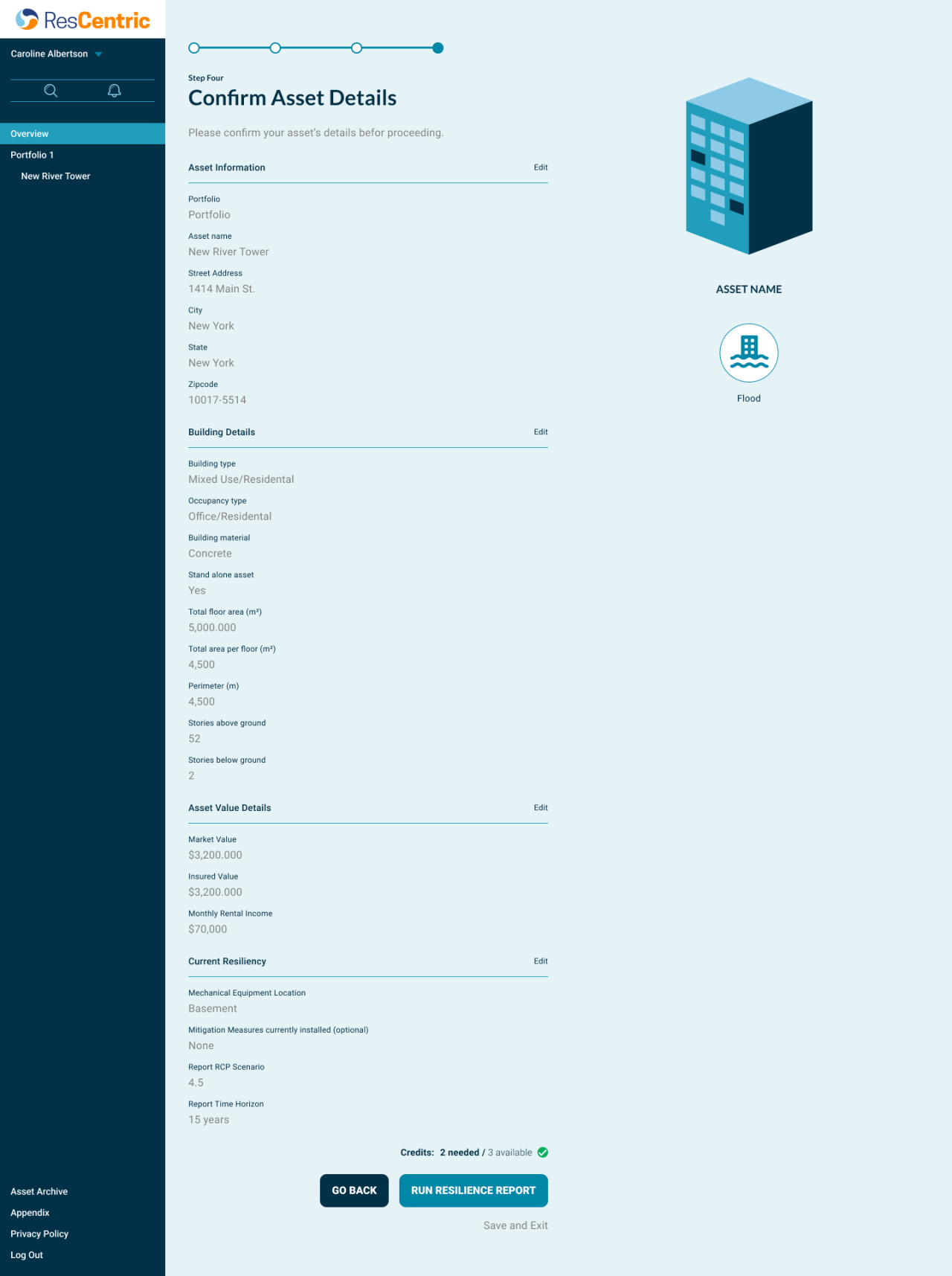

- Address-based analyses don’t account for existing mitigation measures or specific characteristics of the asset

Lack of Realistic, Actionable Mitigation Recommendations

- Current analysis excludes enough granularity when it comes mitigation recommendations or measures in supporting proactive capital decisions

Designing to Learn

Technical Feasibility

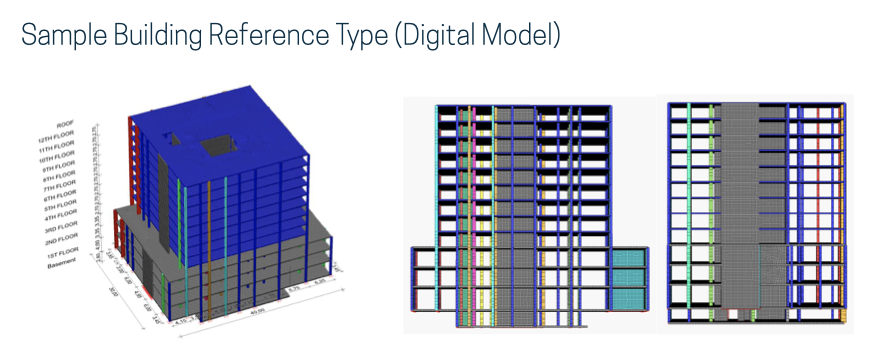

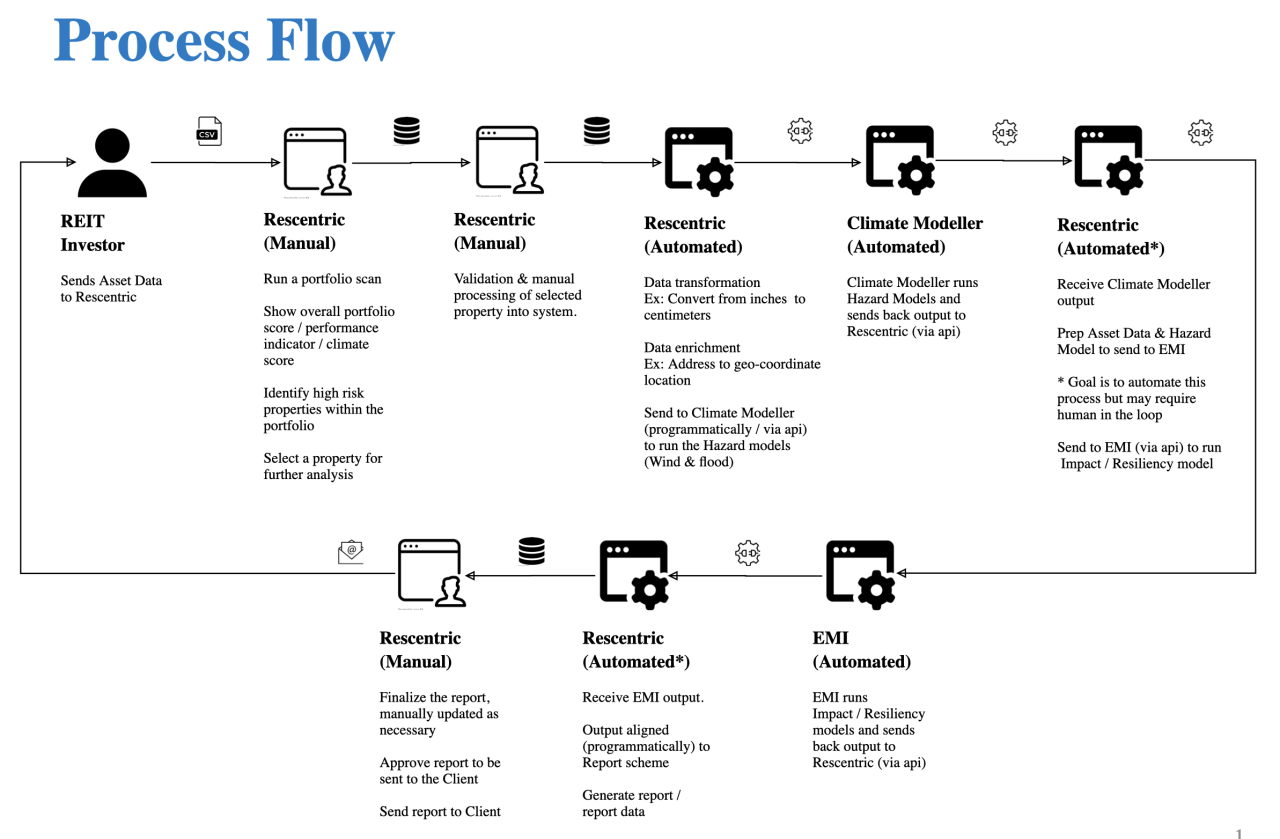

The need for speed meant the ResCentric team needed to address two key things:

- Climate change data by location

- Modeling of specific assets (Digital Twin)

For climate change data, the original hypothesis had been that one of the MunichRe services could provide us the data. However, there were blockers, and the team decided to use a third party source for the POC/MVP and bring that data set internal later. The updated feature hypothesis here was that later on, the clients may want to tap into specific client data sources they already had access to. With this in mind, our system was built to be more nimble for those inputs.

For modeling, we had identified a collaboration partner: Fraunhofer EMI

Along with their team, we were able to combine the third party climate data with a modeling system that enabled us to created a system that utilized limited but specific system inputs, and test them against the selected RCP carbon climate scenarios. The final piece was creating a library of “mitigation measures”, their cost, and effectiveness against those climate scenarios, and modeling the ROI of implementing them either individually or together.

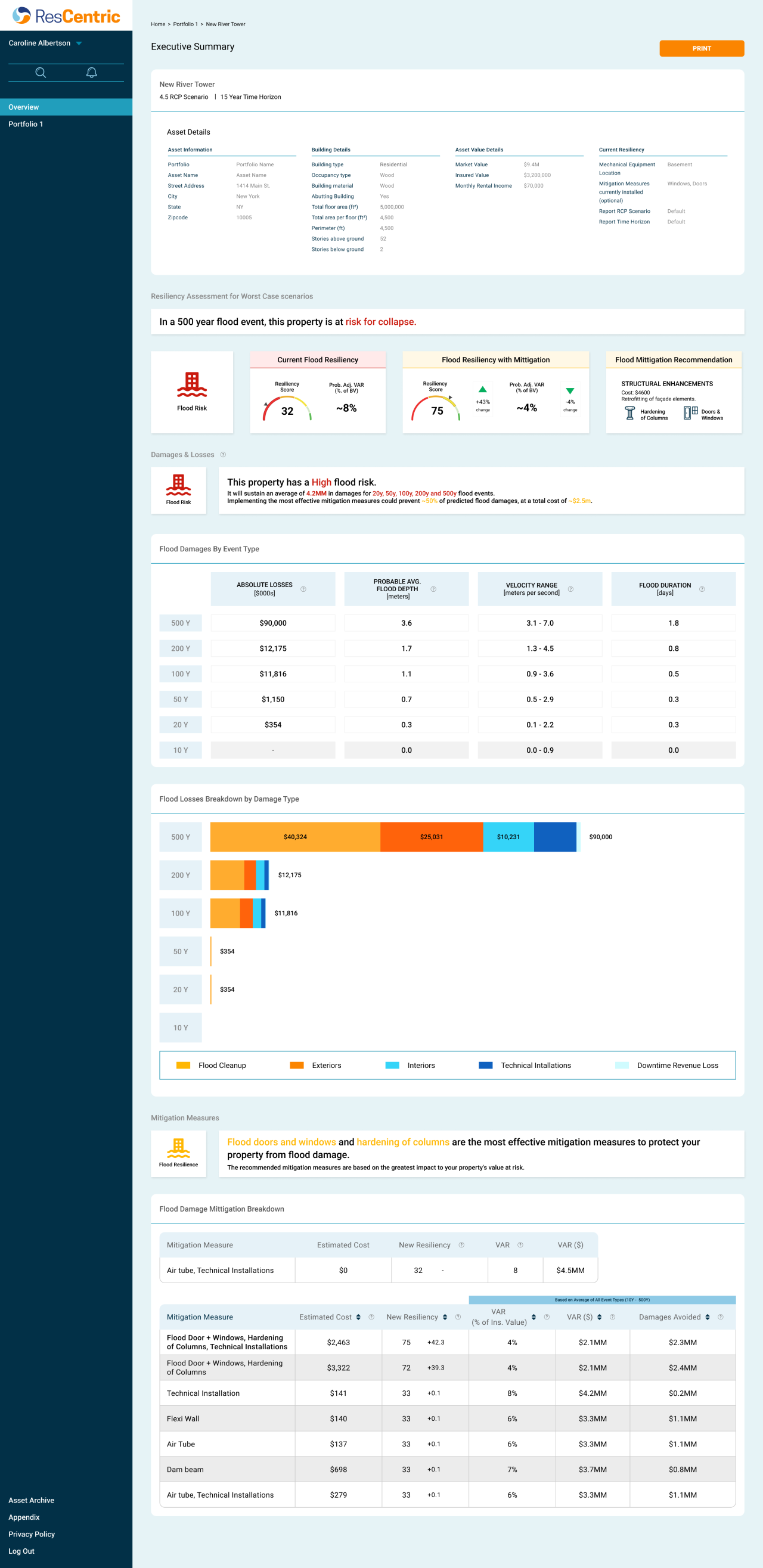

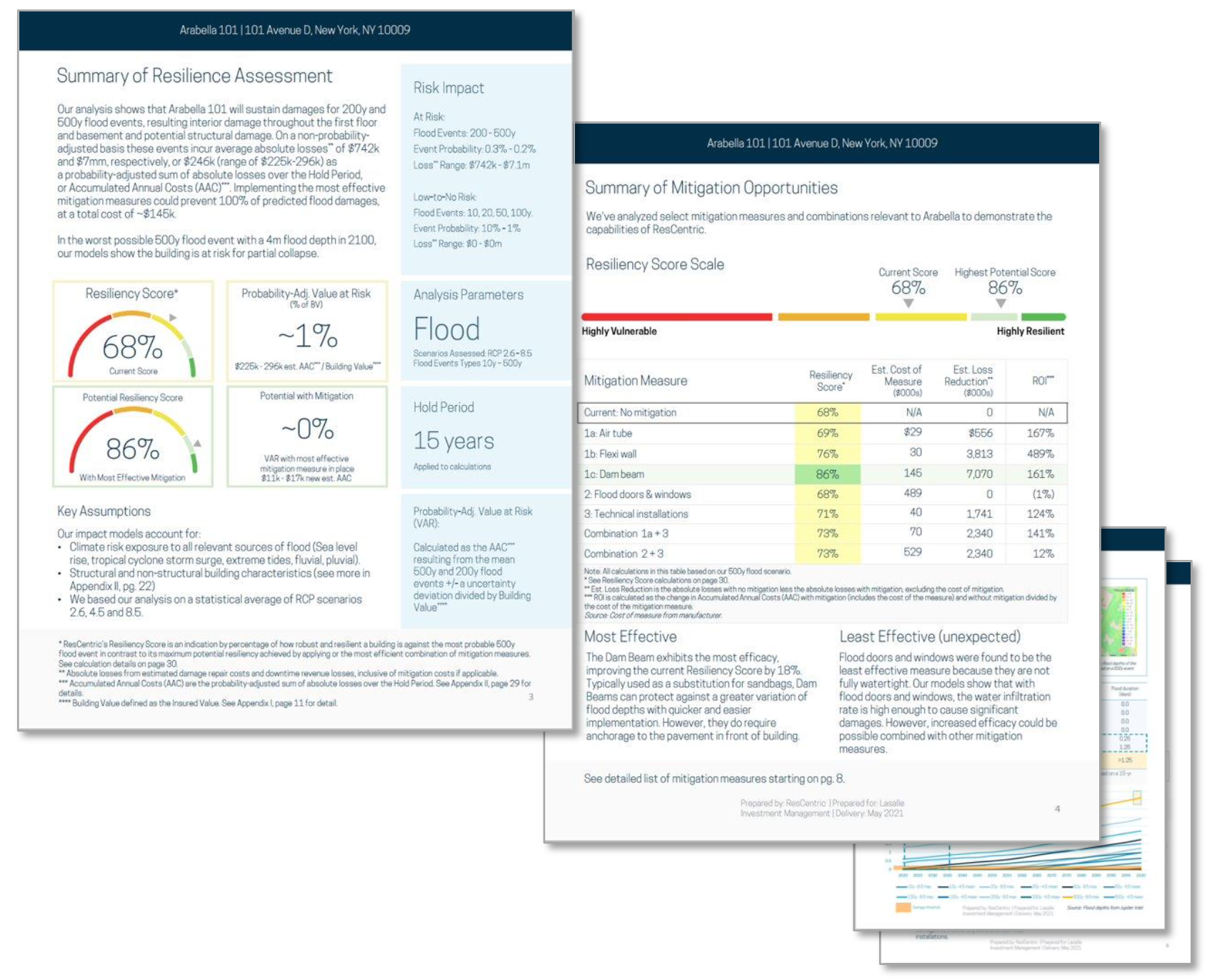

The POC Report

ResCentric’s POC Resilience Assessment Report was very well received by both REIT Customers

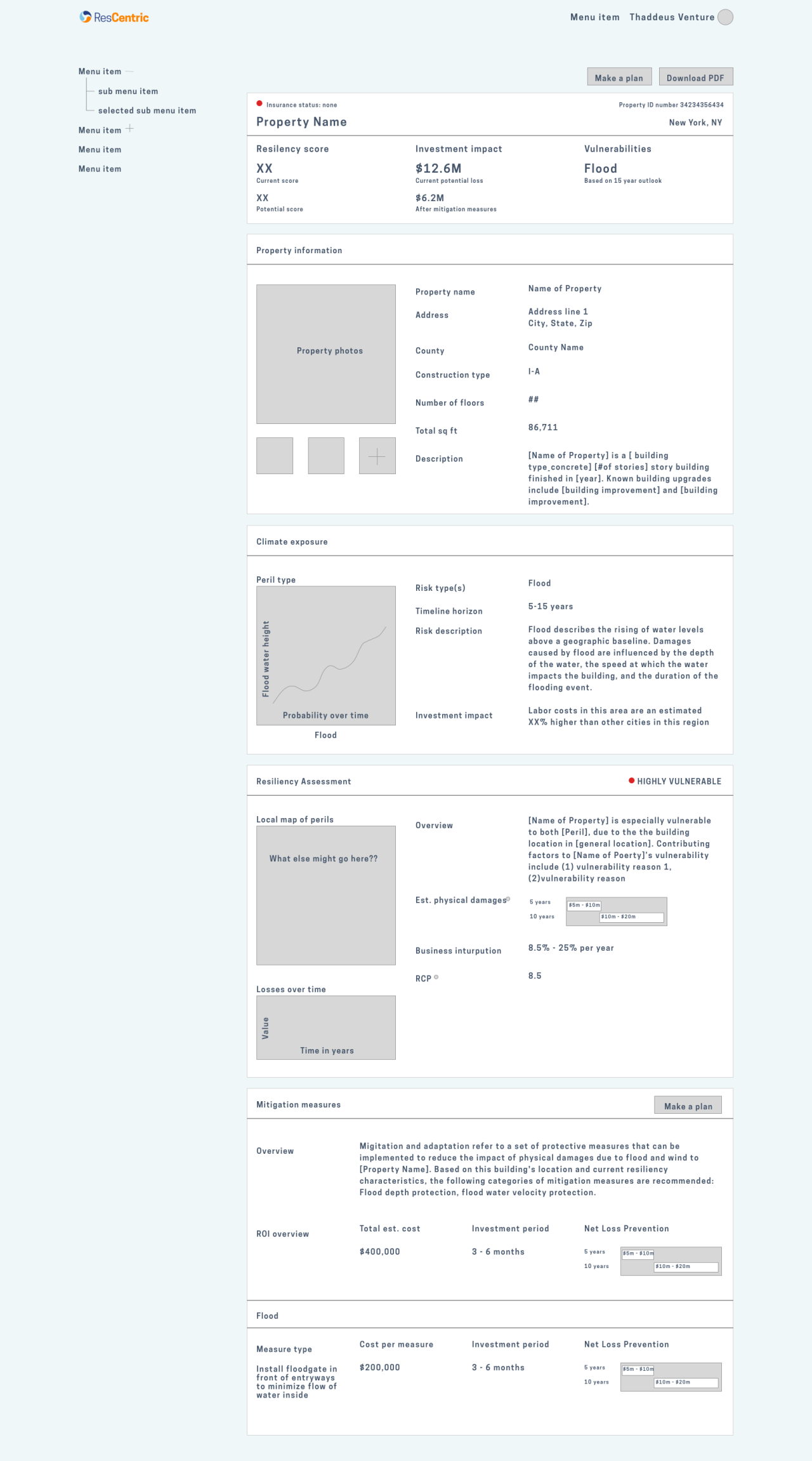

Report Overview:

- 1 peril addressed (flood) based on an average of 2.6-8.5 RCP Scenarios

- Financial impact of physical damage and revenue downtime losses

- 6 mitigation opportunities + 2 combinations analyzed including ROI

- Comparison of Asset Resiliency before and after mitigation measures

Asset-Level Analysis

Analyzing down to asset level allows for granularity and incorporation of hyper-local dynamics

Resilience Analysis + Financial Impact

Converting the risk into dollar and cents, accounting for the buildings structural and non-structural characteristics

Mitigation and Adaptation Measures

Cost benefit analysis for key resilience measures prioritized for the individual asset & inclusive of climate change for any hold period

ResCentric Reception

“I’ve seen enough climate risk analysis reports from different consultants, but this is the first I’ve seen what that I would describe as more actionable and more precise in its recommendations. I found that to be compelling and helpful. It takes you from the theoretical to the practical at an asset level.”

-Head of North American Acquisition Due Diligence, Investment Management firm